If you own your office building or other commercial or residential rental property, you are going to have some upkeep headaches.

Last month, in the article Rental Property, Often Missed: Add New Roof, Deduct the Old One, we explained how you come out ahead financially when you choose to deduct the old roof or other replaced components.

In this article, we elaborate on how deducting the replaced roof, elevator, HVAC, or other components adds to your cash flow and net worth.

In last month’s article, you learned that IRS regulations allow you to elect to write off the old roof or component when you replace it.

The write-off of the old roof creates three tax benefits for you:

- An immediate ordinary loss write-off.Hopefully it’s immediately deductible, but the passive lossrules could delay the benefit.

- A conversion of otherwise unrecaptured Section 1250 gain to capital gain.

- A revenue stream generated by the time value of money. Again, this depends on no delay in the

savings caused by the passive loss rules.

Ordinary Loss Write-Off

We are going to use the facts from last month’s article: You have a building (ignoring the land) that you purchased seven years ago for $4 million. Now, you need to replace the roof and some other components. You use the IRS regulations or a cost segregation study to find that you can deduct $660,000 as an ordinary loss today.

You are in the 40 percent tax bracket, so your immediate cash savings are $264,000 ($660,000 x 40 percent), assuming the passive loss rules pose no problems.

If the passive loss rules delay your deduction until you sell, the $660,000 ordinary loss deduction is there waiting for you, and you deduct it as an ordinary loss. It’s separate from your capital gain on the sale of the building.

Time Value of Money

Let’s say you deduct the $660,000 and invest the $264,000 so that it earns 5 percent after taxes. Your earnings would look like this:

Key point. You gain the time value of money only if you (a) avoid the passive loss rules, (b) elect to deduct the replaced components, and (c) invest the savings (in this case, at 5 percent after taxes).

More Savings When You Sell

When you sell your building for a profit, to the extent that the profit is from your prior building depreciation, you could pay a special capital gain recapture tax of up to 25 percent (this is known technically as “unrecaptured

Section 1250 gain”).

Key point. When you use the partial disposition election, you have no accumulated depreciation on your books for

the disposed assets. With no depreciation, you avoid the tax of up to 25 percent on the uncaptured Section 1250 gain on the disposed assets.

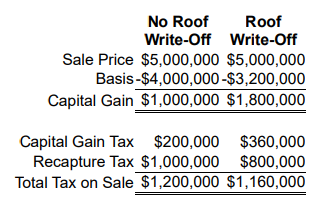

To see how this works when you have to pay the 25 percent tax on your uncaptured Section 1250 gain, say you sell the building for $5 million shortly after you replace the roof and other components. Assume the $4 million basis includes the new roof and other components.

At the point of sale, you realize the benefit of decreasing the basis of the building for the disposed-of roof.

In this example, you pocket an additional $40,000 at the time of sale.

If you sell in a later year, the $40,000 in savings shown above would increase each year because you would be widening the difference in basis. The increase in savings assumes you would be subject to the 25 percent tax on your uncaptured Section 1250 gain in the year of sale.

Reminder: Making the Election Is So Simple

Calculating the write-off of the replaced component calls for some work, but making the actual tax election in your tax return for your partial disposition is downright easy.

To make the election, you simply claim depreciation on the new asset and deduct your loss or report your gain on the old asset in a timely filed tax return (including extensions). Unlike with many elections, you don’t need to attach any special statement or form.

Takeaways

When you replace a structural component in a building, you likely can realize substantial savings:

- An immediate deduction on the write-off of the old component if you can avoid the passive loss

rules. If you run into the passive loss rules, you claim the loss in future years either (a) when you have passive income or (b) when you sell the building. - If you can obtain the immediate deduction, and if you invest the savings, you can grow a nest egg

(perhaps a large one). - You also gain at the point when you sell the building, if you are in a tax bracket greater than 25

percent, because you will have lower unrecaptured Section 1250 depreciation gain recapture taxes.