Here’s the basic idea behind our tax-savings strategies for your portfolio:

- Avoid the high taxes (up to 40.8 percent) on short-term capital gains and ordinary income.

- Lower the taxes to zero—or if you can’t do that, lower them to 23.8 percent or less by making the profits subject to long-term capital gains taxes.

Think of this: you are paying taxes at a 71.4 percent higher rate when you pay at 40.8 percent rather than the tax-favored 23.8 percent.

If you can avoid that higher rate with some easy adjustments in your stock portfolio, doesn’t it make sense to do that now?

Big Picture

Here are the seven basic tax rules you need to know to find the tax savings you desire in your stock portfolio:

Now that you have the basics, here are seven possible tax planning strategies.

Strategy 1: Properly Offset Gains and Losses

Examine your portfolio for stocks you want to unload, and make sales where you offset short-term gains subject to a high tax rate, such as 40.8 percent, with long-term losses (up to 23.8 percent).

In other words, make the high taxes disappear by offsetting them with low-taxed losses, and pocket the difference.

Strategy 2: Properly Use Long-Term Losses

Use long-term losses to create the $3,000 deduction allowed against ordinary income.

Again, you are trying to use the 23.8 percent loss to kill a 40.8 percent tax (or a 0 percent loss to kill a 12 percent tax, if you are in an income tax bracket of 12 percent or lower).

Strategy 3: Avoid the Wash-Sale Rule

As an individual investor, you should avoid the wash-sale loss rule.

Under the wash-sale loss rule, if you sell a stock or some other security and then purchase substantially identical stock or securities within 30 days before or after the date of sale, you don’t recognize your loss on that sale.1 Instead, the tax code makes you add the loss amount to the basis of your new stock.

If you want to use the loss in 2024, then you’ll have to sell the stock and sit on your hands for more than 30 days before repurchasing that stock.

Strategy 4: Don’t Die with Loss Carryovers

If you have lots of capital losses or capital loss carryovers and the $3,000 allowance is looking extra tiny, sell additional stocks, rental properties, and other assets to create offsetting capital gains.

If you sell stocks to purge the capital losses, you can immediately repurchase the stock after you sell it—there’s no wash-sale “gain” rule.

Important note. Don’t die with large capital loss carryovers—they’ll disappear.

- If your carryover originated from you only, then it all goes away if not used on your joint return in the year of your death.

- If your carryover came from joint assets, then your surviving spouse gets 50 percent of the carryover to use going forward.

Key point. Dying kills all or 50 percent of your NOL. Solution: don’t die before you use the NOL.

Strategy 5: Make Use of Lower Tax Brackets

Do you give money to your parents to assist them with their retirement or living expenses? How about your children (specifically, children not subject to the kiddie tax)

If so, consider giving appreciated stock to your parents and your non-kiddie-tax children. Why? If the parents or children are in a lower tax bracket than you are, you get a bigger bang for your buck by

- giving them stock,

- having them sell the stock, and then

- having them pay taxes on the stock sale at their lower tax rates.

You also get a similar family benefit if your parents or children hold the stock for the dividends and then pay taxes on those dividends at their lower tax rate.

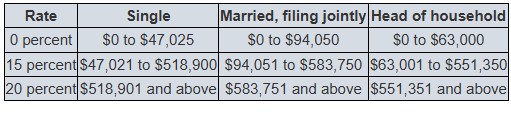

The 2024 dividend and individual capital gain tax rates grouped by taxable income are shown in the table below:

In addition, don’t forget to consider the 3.8 percent additional NIIT, if you are subject to it.

Strategy 6: Donate Appreciated Stock to Charity

If you are going to make a donation to a charity, consider appreciated stock rather than cash because a donation of appreciated stock gives you more tax benefit.

“Whoa!” you exclaim. “Did you say ‘more tax benefit’?”

Yes. It works like this:

- Benefit 1. You deduct the fair market value of the stock as a charitable donation.

- Benefit 2. You don’t pay any of the taxes you would have had to pay if you sold the stock.

Example. You bought a publicly traded stock for $1,000, and it’s now worth $11,000. If you give it to a 501(c)(3) charity, the following happens:

- You get a tax deduction for $11,000.

- You pay no taxes on the $10,000 profit.

Three rules to know:

Strategy 7: Don’t Donate Stock Losses to Charity

If you could sell a publicly traded stock at a loss, do not give that loss-deduction stock to a 501(c)(3) charity. Why? If you sell the stock, you have a tax loss that you can deduct. If you give the stock to a charity, you get no deduction for the loss—in other words, you can just kiss that tax-reducing loss goodbye.

Solution. Sell the stock first to create your tax-deductible loss. Then give the charity the cash realized from your sale of the stock to create your deduction for the charitable contribution.

Example. You bought a stock for $13,000, and it’s now worth $2,000. If you give the stock to a charity, here’s what happens:

- You deduct $2,000 (fair market value).

- The charity receives $2,000 (the value of the stock).

- You kiss your $11,000 ($13,000 – $2,000) tax-deductible loss goodbye.