With all that happened in 2024, it’s easy to forget your Section 199A deduction.

You may remember that the Tax Cuts and Jobs Act (TCJA) gave many pass-through businesses the Section 199A deduction as a no-effort, do-nothing 20 percent tax deduction based on defined business income.

For example, with defined qualified business income (QBI) of $100,000 and defined taxable income of $100,000, you qualify for a $20,000 Section 199A deduction that you claim on your Form 1040. You didn’t have to do anything to get this deduction.

One thing to be aware of: tax planning that reduces your business income can also reduce your Section 199A deduction. For example, let’s say you buy $40,000 of equipment and expense it. Now your QBI is $60,000 ($100,000 – $40,000) and your 199A deduction is $12,000 ($60,000 x 20 percent).

Your planning for the Section 199A deduction requires more attention if your 2024 taxable income exceeds the threshold: $191,950 (or $383,900 on a joint return).

In this article, we bring you three Section 199A strategies you can implement before December 31, 2024, to help you obtain your optimal deduction.

First Things First

If your Form 1040 taxable income is above $191,950 (or $383,900 on a joint return), then your type of business, wages paid, and property can reduce and/or eliminate your Section 199A tax deduction.1

The combinations can create confusion, but you can lessen the confusion by using the 2024 Section 199A calculator.

Planning point. In general, when planning for your Section 199A deduction, you need to look at the following:

- Your 1040 taxable income. This determines your eligibility for the 199A deduction. It is also part of the equation that limits your deduction to no more than 20 percent of your taxable income, less capital gains.

- Your QBI, wages paid, and type of business (in-favor or out-of-favor). This determines the deduction, which, as above, is limited to no more than 20 percent of your taxable income, less capital gains.

The 2024 Section 199A calculator helps you do this on a business-by-business basis. If you have more than one business, spend a few minutes with Caution: 199A Calculator Is Business-by-Business without Aggregation.

If your Section 199A deduction is less than 20 percent of your QBI, consider using one or more of the strategies discussed below to increase your deduction.

Strategy 1: Harvest Capital Losses to Reduce Taxable Income

Capital gains add to your taxable income.

- Taxable income determines your eligibility for the Section 199A tax deduction.

- Taxable income, less capital gains, sets the upper limit (ceiling) on the amount of your Section 199A tax deduction.

If the capital gains are hurting your Section 199A deduction, you have time before the end of the year to harvest capital losses to offset those harmful gains.

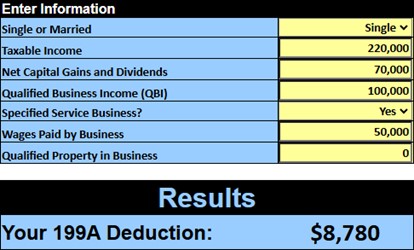

Example. Susan is single. She has QBI of $100,000 and taxable income of $220,000, of which $70,000 is net capital gain. Her business is an out-of-favor specified service business with $50,000 in wages and no qualified property.

If Susan takes no action, her Section 199A deduction is $8,780 because she is above the threshold and in the phaseout range.

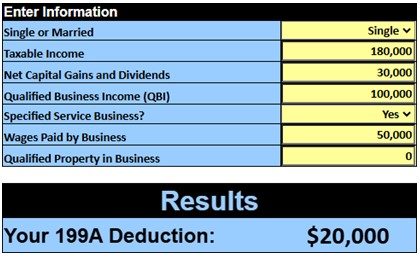

If Susan harvests $40,000 in capital losses—say, from her stock portfolio—she is now below the threshold ($220,000 – $40,000 = $180,000), and her Section 199A deduction increases to $20,000, as the calculator shows.

By using the capital gains offset strategy, Susan has obtained a total federal tax cash benefit of $8,693 from the capital loss, as follows:

$6,000 in cash from the reduced capital gain taxes (15 percent of $40,000)

$2,693 from the additional Section 199A deduction (24 percent of $11,220 [$20,000 – $8,780])

Doing the Section 199A deduction in your head or by hand is time-consuming and difficult—and it often comes out incorrect. The calculator is a big help. When you’re weighing strategies as we did above, use the calculator.

Strategy 2: Make Charitable Contributions to Reduce Taxable Income

Since the Section 199A deduction uses taxable income for its thresholds, you can use itemized deductions to reduce and/or eliminate threshold problems and increase your Section 199A deduction.

Charitable contribution deductions are the easiest way to increase your itemized deductions before the end of the year. Consider doing one or both of the following:

- Donate appreciated stock, as we discuss in 2024 Last-Minute Year-End Tax Strategies for Your Stock Portfolio. Prepay (before December 31, 2024) your planned 2025 charitable contributions so you can claim them as deductions this year.

Example. Let’s assume Susan (from our example above) decides to donate appreciated stock to her favorite charity instead of harvesting losses in her stock portfolio.

She donates appreciated stock with a value of $40,000 and a built-in long-term capital gain of $35,000 to her favorite charity.

If the donation increases her itemized deductions by $40,000, her taxable income drops by $40,000.

With this strategy, Susan saves $14,537 in 2024 federal income taxes from the stock donation:

- $11,844 from the $40,000 charitable contribution, which comes from two tax brackets (32 percent of $28,050 + 24 percent of $11,950), and

- $2,693 from the additional Section 199A deduction (24 percent of $11,220 [$20,000 – $8,780])

Susan also eliminated $6,000 in future capital gain taxes (15 percent of $40,000) because the stock donation removed the capital gain from her portfolio.

Strategy 3: Buy Business Assets

Thanks to Section 179 expensing, you can write off the entire cost of most business assets you buy and place in service before December 31, 2024. Alternatively, you can deduct 60 percent bonus depreciation plus MACRS depreciation, giving you a 2024 deduction for a nice chunk of the cost.

The big asset purchase can help your Section 199A deduction in two ways:

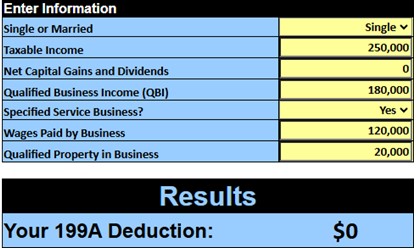

Example. Jim, who is single, runs his medical practice as an S corporation. He has Form 1040 taxable income of $250,000, and the S corporation has QBI of $180,000, wages of $120,000, and UBIA of $20,000.

If Jim takes no action, his Section 199A deduction is $0 because his taxable income is above the 199A upper threshold of $241,950 and his business is an out-of-favor specified service business.

Let’s say that before December 31, 2024, Jim buys and places in service medical equipment costing $50,000 that he had previously planned to buy over the next one to two years.

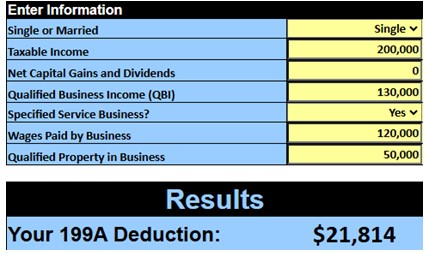

Assuming Jim fully expenses the property, he saves $23,168 in federal income taxes:

- $16,188 from the $50,000 equipment write-off, which comes from two tax brackets (35 percent of $6,275 + 32 percent of $43,725), and

- $6,980 from the Section 199A deduction. (Note that the $50,000 of expensing reduces both Jim’s taxable income and his QBI. We use the calculator to see that Jim now has a $21,814 Section 199A deduction. His tax benefit is 32 percent of that, or $6,980.)

Takeaways

If your 2024 taxable income is over $191,950 (or $383,900 on a joint return), you could face a reduced or eliminated Section 199A deduction.

In such cases, consider using one or more of the three strategies described in this article to reduce your taxable income and increase your Section 199A deduction. The three strategies are as follows:

Final points. The Section 199A deduction can get confusing. Be sure to use our 2024 Section 199A calculator to run the numbers so you can identify your correct Section 199A deduction. If you have more than one business, make sure to review Caution: 199A Calculator Is Business-by-Business without Aggregation.