Get ready for a wild ride.

The Tax Cuts and Jobs Act (TCJA) included many federal tax provisions that affected individuals. Some are good, and some are bad.

Most of them are scheduled to expire at the end of 2025. For you, that means for sure tax changes are coming—perhaps a ton of them because you know Congress will get involved.

Here’s a rundown of expiring and permanent TCJA provisions that are most likely to affect you as an individual.

And to make this more interesting, we labeled the scheduled expirations and permanent provisions as

Here goes.

Good News: Expiration of TCJA Rules for State and Local Tax (SALT) Deductions

Before the TCJA, you could claim itemized deductions for an unlimited amount of personal state and local income and property taxes. You also had the option of forgoing any deduction for state and local income taxes and instead deducting state and local general sales taxes.

For 2018-2025, the TCJA limits itemized deductions for personal state and local income and property taxes to a combined total of $10,000, or $5,000 for those who use married-filing-separately status.

For 2018-2025, you cannot deduct foreign real property taxes at all.

You can still opt to deduct state and local general sales taxes instead of state and local income taxes, subject to the $10,000/$5,000 limitation.

Expiration. The more favorable pre-TCJA rules for personal state and local income tax itemized deductions are scheduled to return for 2026 and beyond unless future legislation changes that outcome.

Good News: Expiration of TCJA Rules for Home Mortgage Interest Deductions

For 2018-2025, the TCJA generally allows you to claim itemized deductions for qualified residence interest on up to $750,000 of home acquisition mortgage debt incurred to buy or improve a first or second residence, or $375,000 for those who use married-filing-separately status. Before the TCJA, the debt limits were $1 million and $500,000, respectively.

For 2018-2025, the TCJA suspends the provision that previously allowed you to deduct interest on up to $100,000 of home equity loan balances.

Expiration. The more generous pre-TCJA rules for itemized home mortgage interest deductions are scheduled to return for 2026 and beyond unless future legislation changes that outcome.

Good News: Expiration of TCJA Rule for Miscellaneous Itemized Deductions

For 2018-2025, the TCJA suspends write-offs for miscellaneous itemized expenses that were previously subject to the 2-percent-of-adjusted gross income (AGI) deduction threshold. These expenses included investment expenses and unreimbursed employee business expenses.

Expiration. The more favorable pre-TCJA rules for miscellaneous itemized deductions are scheduled to return for 2026 and beyond unless future legislation changes that outcome.

Good News: Expiration of TCJA Rule for Personal Casualty and Theft Loss Deductions

For 2018-2025, the TCJA generally suspends itemized deductions for personal casualty and theft losses, except for losses incurred in federally declared disasters.

Expiration. The pre-TCJA rules for personal casualty losses, which allowed deductions for losses not tied to federally declared disasters, are set to return in 2026 unless future legislation alters this outcome.

Bad News: Return of Itemized Deduction Phaseout Rule

Before the TCJA, higher-income individuals were subject to a phaseout rule that could eliminate up to 80 percent of the most popular itemized deductions—including home mortgage interest, property taxes, and charitable donations. For 2018-2025, the TCJA suspends the itemized deduction phaseout rule.

Expiration. The unfavorable pre-TCJA phaseout rule is scheduled to return for 2026 and beyond unless future legislation changes that outcome.

Good News: Expiration of TCJA Disallowance of Moving Expense Deductions

For 2018-2025, the TCJA suspends deductions for moving expenses except for certain members of the Armed Forces. Before the TCJA, many individuals could deduct allowable moving expenses “above the line,” meaning they did not need to itemize to claim the write-off.

Expiration. The more favorable pre-TCJA treatment of moving expenses is scheduled to return for 2026 and beyond unless future legislation changes that outcome.

Good News: Expiration of TCJA Treatment of Employer-Paid Moving Expenses

Before the TCJA, employer payments and reimbursements for eligible moving expenses were tax-free. For 2018-2025, the TCJA suspends this favorable treatment, except for certain Armed Forces members. For everyone else, employer payments and reimbursements must be included in the recipient employee’s taxable income and reported as income on Form W-2.

Expiration. The more favorable pre-TCJA treatment of employer payments and reimbursements for eligible moving expenses is scheduled to return for 2026 and beyond unless future legislation changes that outcome.

Mixed News: Expiration of TCJA Rules for Charitable Donations

When it comes to charitable deductions, the TCJA giveth and it taketh away. Before the TCJA, deductions for cash contributions to public charities and certain private foundations were limited to 50 percent of AGI. Thanks to the TCJA, the deduction limit was increased to 60 percent of AGI for 2018-2025.

Expiration. The less generous 50-percent-of-AGI deduction limit is scheduled to return for 2026 and beyond unless future legislation changes that outcome.

For less ambitious givers, charitable deductions may be somewhat harder to come by under the TCJA. That’s because to deliver any tax-saving benefit, your itemizable deductions (including charitable donations) must exceed the applicable standard deduction. The TCJA greatly increased the standard deduction amounts for 2018-2025.

Expiration. The standard deduction amounts are scheduled to return to much lower pre-TCJA levels (with cumulative inflation adjustments) for 2026 and beyond unless future legislation changes that outcome. If that happens, it would allow more individuals to claim itemized charitable deductions.

Bad News (Permanent): TCJA Treatment of Charitable Donations Creating Entitlement to Buy Tickets to College Athletic Events

Before the TCJA, you could treat 80 percent of a payment as a deductible charitable donation if (1) the payment was to or for the benefit of a college, and (2) the payment would be treated as a deductible charitable donation except that the payment entitled you to receive (directly or indirectly) the right to buy tickets to athletic events of the college. The TCJA eliminated charitable deductions under such arrangements.

Expiration. Not applicable (N/A). This is a permanent change.12

Mixed News (Permanent): TCJA Treatment of Alimony Payments

For alimony payments required by divorce or separation instruments executed after 2018, the TCJA eliminated deductions for alimony payors that were allowed under prior law. The TCJA also eliminated the requirement that recipients of such alimony payments must include them in taxable income.

More specifically, the TCJA treatment of alimony payments applies to payments required under divorce or separation instruments that are

These changes were bad news for alimony payors and good news for alimony recipients.

Expiration. N/A. These are permanent changes.

Good News: Expiration of TCJA Rule for Professional Gamblers’ Deductions

For 2018-2025, the TCJA stipulates that combined deductions for a professional gambler’s out-of-pocket gambling-related expenses and gambling losses incurred during the year are limited to gambling winnings during the year.

Before the TCJA, a professional gambler could deduct out-of-pocket gambling-related expenses as a Schedule C business expense without regard to the gambling winnings limitation. Only deductions for actual gambling losses (wagering losses) were limited to gambling winnings.

Expiration. The more favorable pre-TCJA rule for professional gamblers is scheduled to return for 2026 and beyond unless future legislation changes that outcome.

Key point. Amateur gamblers have never been allowed to deduct out-of-pocket gambling-related expenses. That is still true under the TCJA.

Bad News: Expiration of TCJA Rules for Child and Dependent Tax Credits

For 2018-2025, the TCJA increases the maximum child credit to $2,000 per qualifying child (up from $1,000 under prior law). For 2024, up to $1,700 can be refundable—meaning taxpayers can collect the credit even when they don’t owe any federal income tax.

For 2018-2025, the income levels at which the child tax credit is phased out are significantly increased, so many more families with under-age-17 children are not phased out and qualify for the credit.

Expiration. The stricter pre-TCJA child tax credit rules are scheduled to return for 2026 and beyond unless future legislation changes that outcome.

For 2018-2025, the TCJA established a new $500 credit for eligible non-child dependents.

Expiration. The $500 credit for eligible non-child dependents is scheduled to expire for 2026 and beyond unless future legislation changes that outcome.

Bad News (Permanent): TCJA Treatment of Personal Property Exchanges

Under the TCJA, tax-deferred Section 1031 treatment is allowed only for qualifying exchanges of real property. No more Section 1031 treatment for exchanges of personal property.

Expiration. N/A. This is a permanent change.

Bad News (Permanent): TCJA Repeal of Roth Conversion Reversal Privilege

The TCJA eliminated the opportunity for you to reverse the conversion of a traditional IRA into a Roth account. Before the TCJA, you had until October 15 (adjusted for weekends) of the year after an ill-advised conversion to reverse it and thereby avoid the conversion tax hit.

Expiration. N/A. This is a permanent change.

Bad News: Expiration of TCJA Estate and Gift Tax Exemptions

For 2018-2025, the TCJA establishes a much more favorable federal estate and gift tax regime. The TCJA retained the flat 40 percent tax rate on estates and gifts in excess of the unified federal estate and gift tax exemption, but the exemption was hugely increased to the inflation-adjusted amount of $13.61 million for 2024 (versus only $5.49 million for 2017).

Expiration. The unified exemption is scheduled to fall back to the pre-TCJA level for 2026 and beyond (with a cumulative inflation adjustment) unless future legislation changes that outcome.

Mixed News: Expiration of TCJA Tax Rates for Ordinary Income and Short-Term Capital Gains

For 2018-2025, the TCJA retained seven ordinary income tax rates for individuals.

Good news. Five of the rates under the TCJA are lower than before.

Bad news. For singles and heads of households, the thresholds for the 35 percent rate were significantly lowered by the TCJA. So, more upper-middle-income individuals fall within the 35 percent rate bracket than before.

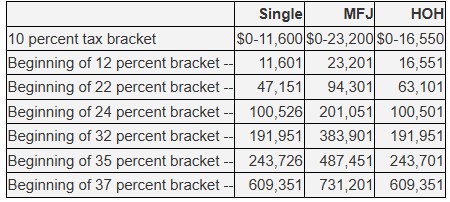

The 2024 individual rate brackets for ordinary income are as follows (for single, married-filing-jointly, and head-of-household taxpayers, respectively):

Assuming no legislation to the contrary, these bracket thresholds will be adjusted for inflation for 2025.

Expiration. For 2026 and beyond, the rates and bracket thresholds that were in place for 2017 (with cumulative inflation adjustments for bracket thresholds) are scheduled to return unless future legislation changes that outcome. Perhaps most important,

No News: Tax Rates for Long-Term Capital Gains and Qualified Dividends

The TCJA retained the 0 percent, 15 percent, and 20 percent tax rates on net long-term capital gains (LTCGs) and qualified dividends.

Before the TCJA:

The TCJA established separate 0 percent, 15 percent, and 20 percent rate brackets for net LTCGs and qualified dividends, but that change had no meaningful impact.

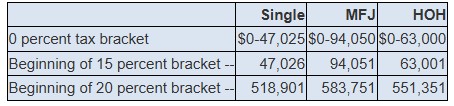

The capital gains tax brackets for 2024 are as follows.

Assuming no legislation to the contrary, these bracket thresholds will be adjusted for inflation for 2025.

Expiration. For 2026 and beyond, the rate brackets for net LTCGs and qualified dividends that were in place for 2017 (with cumulative inflation adjustments for the bracket thresholds) are scheduled to return unless future legislation changes that outcome. As mentioned, this will not have a meaningful impact on your tax bill.

Bad News: Expiration of TCJA Alternative Minimum Tax Rules

The alternative minimum tax (AMT) rules under the TCJA are much more taxpayer-friendly than before.

For 2024, the maximum 28 percent AMT rate starts when AMT income exceeds $232,600 for married joint-filing couples, singles, and heads of households, and $116,300 for those who use married-filing-separately status. Below those thresholds, the AMT rate is 26 percent.

Under the AMT rules, you are allowed an inflation-adjusted AMT exemption, which you deduct in calculating your AMT income. The exemption is phased out when your AMT income surpasses the applicable threshold, but the TCJA greatly increased those thresholds for 2018-2025.

Expiration. The much less favorable (actually, downright ugly) pre-TCJA AMT rules for individuals are scheduled to return for 2026 and beyond unless future legislation changes that outcome.

Mixed News: Expiration of TCJA Rules for Standard Deductions and for Personal and Dependent Exemption Deductions

For 2018-2025, the TCJA drastically increased standard deduction amounts. The 2024 standard deduction amounts are as follows:

Additional amounts apply for elderly and blind individuals.

Expiration. The pre-TCJA standard deduction amounts (with cumulative inflation adjustments) are scheduled to return for 2026 and beyond unless future legislation changes that outcome. For example, the 2017 standard deduction for married joint-filing couples was only $12,700. That number would be adjusted for inflation, but it’s still only about half of the TCJA amount.

For 2018-2025, the TCJA suspended personal and dependent exemption deductions, which would have been $5,050 each for 2024 if they were still allowed.23

Expiration. The pre-TCJA personal and dependent exemption deduction amount (with a cumulative inflation adjustment) is scheduled to return for 2026 and beyond unless future legislation changes that outcome.

Takeaways

The TCJA brought significant changes for individual taxpayers, creating clear winners and losers. Here’s what to keep in mind.

Scheduled expirations. Many taxpayer-friendly provisions are scheduled to sunset. For sure, this has lawmakers’ attention and will likely lead to substantial tax legislation. That could occur soon, certainly before the end of 2025.

Permanent changes. Some changes are here to stay, at least until the next tax law change. These include the repeal of Roth recharacterizations, limits on Section 1031 exchanges, and new rules for alimony taxation—offering mixed benefits, depending on your circumstances.

Big picture. The return of pre-TCJA rules would trigger higher taxes. Lawmakers don’t want that. You can expect congressional action—and likely some additional tricky rules to navigate in the near future.

Action step. Stay with us. We’ll help you navigate the changes and keep your taxes as low as possible.